Nedbank offers a money market account termed JustInvest, to help people save money while earning interest. But how exactly does it work, this is an overview of how the Nedbank JustInvest account works.

What is a money market account?

A money market account is very similar to a savings account, there are just some minor differences. Most money markets accounts have minimum deposits and are offered by banks and credit unions. You are able to make additional deposits and withdrawals. The cash is available almost immediately or after a certain amount of waiting period. With Nedbank this is just 24 hours.

Interest rate from money market accounts can sometimes be more or less than interest rates on a traditional savings account. It mostly depends on which bank or institution is offering it.

How does Nedbank JustInvest work?

With the Nedbank JustInvest you have to put a minimum deposit of R500 and you can make additional deposits of not less than R100 at a time. There are no monthly fees or commissions and you will need to put a notice of 24 hours before accessing your money.

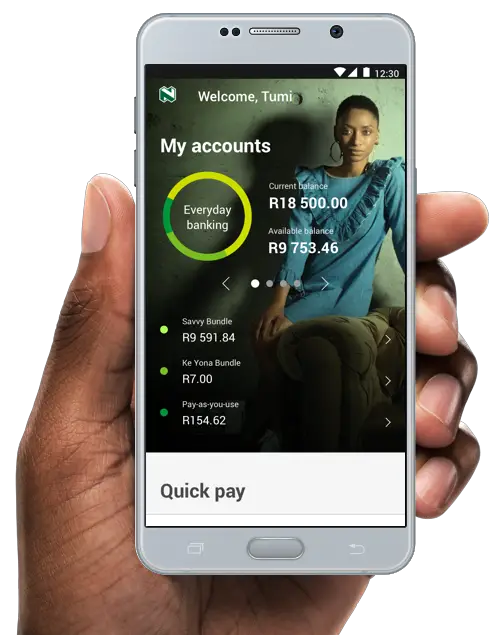

You can open this account directly from your Nedbank Money app, just navigate to the investment section and find “JustInvest”. Nedbank gives you a calculator, which you can use to calculate the interest you will earn with your investment.

For exactly R500, you will earn 1.75% per year, which is around R0.72 per month, for R5000, you will earn 2.25%, which is around R9.25 per month (at the time of writing this article). The interest can be as high as 3.25% but it needs you to put up hundreds of thousands.

Conclusion

This was an overview of how the Nedbank JustInvest account works. Do you have any thoughts or questions? Comment below.