Nedbank offers a 32Day notice account, but how exactly does it work? This is an overview of how the Nedbank 32Day account works.

Overview

The Nedbank 32Day account is a savings account/deposit account. You put your money in the account, it accumulates interest but you can only withdraw it after giving a notice of 32 days. The minimum amount of money you can put is R250.

The current interest rate is 2.95% per year for R10k at the time of writing this article, you don’t pay any monthly fees or commissions. This means that you will earn close to 3% every year if you put your money in this account today.

To put things in perspective, you can earn 7% when saving money with TymeBank and you only need to put a notice period of 10 days. The inflation rate in South Africa is currently hovering around 4%.

This is something you should probably invest in if you want your money in the short term, if you are only saving for 3 months and will probably not save again for a long time.

How to open the account

It’s very easy to open the Nedbank 32Day notice account. All you have to do is:

- Open an account with Nedbank.

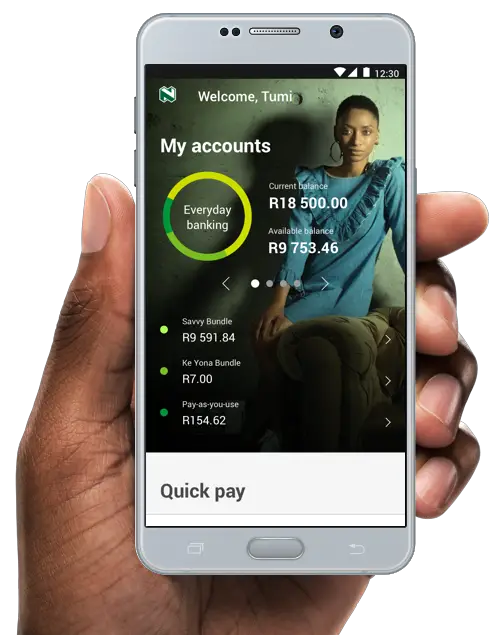

- Download the Nedbank Money app.

- Click on “More”.

- Click on “apply”.

- Tap on “grow investments”.

- Select “Everyday investments”.

- Select “Electronic 32Day Notice.

- Make your investment.

You won’t have to upload any documents or anything like that. All you have to do is to allocate capital to the account.

Conclusion

This was an overview of how the Nedbank 32Day account works. Do you have any thoughts or questions? Comment below.