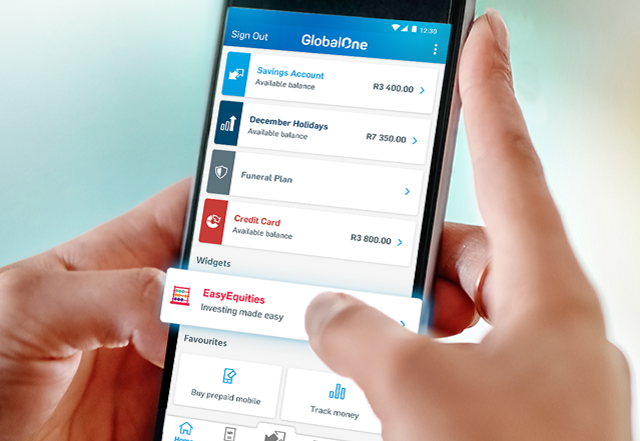

Saving money through the Capitec app is easy and effortless. This is an overview of How the Capitec app saves money

There are multiple ways in which the Capitec app saves money, this goes from using saving savings account to saving some money by using the Capitec app to transact.

Savings accounts

You can sign up for the flexible savings account and the tax-free savings account directly through the Capitec app. These are accounts that you can use to save money while earning interest. You don’t need to give a notice period for withdrawals on the flexible savings account.

The interest rate tends to be low at just around 2%, this is way less than the 7% that you would get by using TymeBank. A tax-free savings account means that you won’t pay interest on any amount of money that you earn. You can contribute a maximum of up to R36k per year in a tax-free savings account.

Transactional costs

You can save a lot of money by using the Capitec app to make most of your transactions as this will reduce your monthly costs. You can get a bank statement for free through the Capitec app and can make payments for a low fee. Just avoid using the ATM as much as possible, use your Capitec card or scan to pay for your products.

You can also opt to receive notifications through the Capitec app and not the SMS. You will be able to receive the notifications even when you don’t have any data.

Conclusion

This was an overview of how you could save money through the Capitec app. Do you have any thoughts or questions? Comment below.